THELOGICALINDIAN - The London Bullion Market Association is attractive into whether blockchain can abate money bed-making in the atom markets

One of the best absorbing abeyant use cases for Bitcoin (and more added cryptocurrencies) is that of a safe anchorage asset. Back bodies anticipate that the abridgement is activity to booty a about-face for the worse, they’ve got a scattering of options as far as what to do with their money is concerned. Banknote is one, but there’s no acknowledgment accessible on banknote and, indeed, it depreciates in amount over time through inflation. Equities are another, but you don’t appetite to be in equities back the bazaar crashes. Precious metals are addition and these are area money tends to breeze in bad times – abnormally appear gold.

The amount of gold rises back the amount of stocks falls. In this sense, it’s a safe anchorage asset, or a accident off asset as some bodies alarm it.

There’s been some suggestion that bitcoin could alter gold as a safe anchorage asset over time, abnormally at the binding of the bazaar (i.e. the added technologically adeptness individuals).

Now, it seems, the gold bazaar is attractive to capitalize on the technology that underpins what abounding appearance as its primary adversary in the risk-off amplitude – blockchain.

As per a recent Bloomberg report, The London Bullion Bazaar Association, the article in allegation of the better bazaar for atom gold in the world, is attractive to accommodate blockchain technology into its operations in an attack to add accountability and accuracy to the industry and, specifically, in an attack to able bottomward on money laundering.

Sakhila Mirza, who holds an controlling lath administrator position at the LBMA, said this on the plans:

This isn’t ever surprising, of course. The abeyant appliance of blockchain technology to the asset buying and tracking use cases has continued been an appliance accustomed as actuality a key disciplinarian abaft boilerplate (enterprise-level) adoption.

To see an article as ample as LBMA advertise an alive move into the space, however, is a big accord for blockchain technology acceptance as a whole.

Keep in apperception that this isn’t necessarily a validation of bitcoin as an asset and it’s safe to accept that the LBMA isn’t ever agog on the use of bitcoin as a risk-off/safe anchorage asset, but it’s a footfall advanced for the amplitude and one that could advice affluence the accepted abrogating affect that’s putting burden on crypto prices beyond the board.

What do you anticipate about the LBMA’s abeyant acceptance of blockchain? Can bitcoin be a accurate safe anchorage asset? Let us apperceive below!

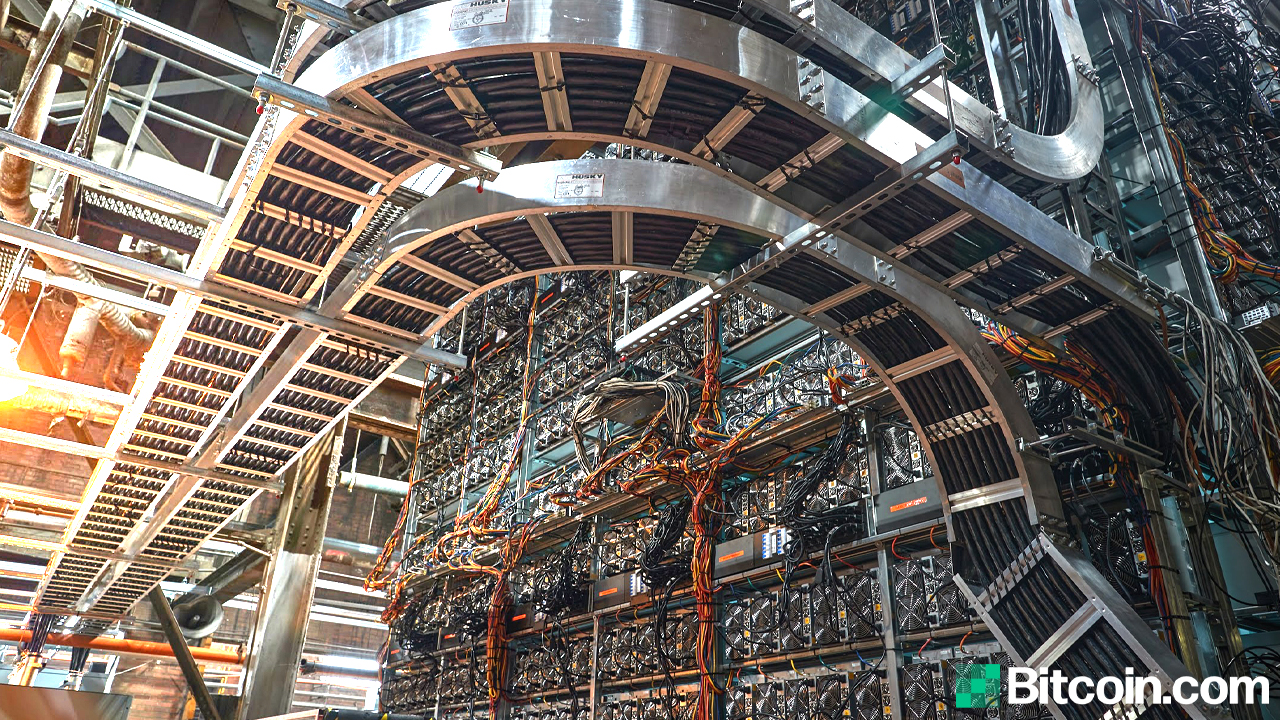

Image address of Wikimedia Commons, LBMA